Bankruptcy is a difficult and emotionally charged process. It can cause financial turmoil and carry a negative stigma. Despite this, when faced with overwhelming debt and no positive cash flow, bankruptcy may be an option. Before making any decisions, it is important to consider all available alternatives. Strong emotions can lead to unsound financial choices with severe consequences.

As a mortgage lender for almost 40 years, I’ve met with a LOT of clients that were overwhelmed with their debt. There are a lot of reasons someone may come to that conclusion. They may have been laid off from work or had their hours cut. They may be going through a divorce or had a medical emergency. Everyone’s situation is different.

Get Organized and Re-evaluate!

However, I often found that the situation could be mitigated by getting organized and putting a sound financial plan together. It’s hard for people who are in this situation to come to this conclusion on their own because they’ve become emotionally worn down by the late fees and the creditor phone calls.

I’m not trying to make lite of a bad situation. I’m just saying that sometimes we need to step back and take a more objective evaluation of the situation. Or, seek the advice of someone that can assist you with that evaluation to see if there are better alternatives to bankruptcy.

However, I wouldn’t recommend procrastinating. The longer one postpones addressing this issue, the more severe their financial situation may become. While borrowing additional funds to settle existing debts might appear as a possible solution, it typically exacerbates the problem and prolongs the inevitable because the terms of a loan at this point will not be favorable.

Bankruptcy Alternative

I’d recommend listing out all your debts. Who do you owe? What are the terms (i.e. fixed payment, revolving debt)? What is the interest rate? What is the balance? What is the payment?

By doing this, a new plan may materialize. As an example; I had a client that had a car payment of $478 with a balance of roughly $7,000. He had a credit card with enough room to pay off the car. She didn’t think it would be a good idea because the rate of interest on the car was 4.9% and the credit card was 20.9%, however by doing it, her new “minimum” payment on the credit card was $74. This improved her cash flow by $404 per month. Not only did that relieve some financial pressure, we used that extra cash flow to seriously pay down other bills. I won’t go into the full strategy we used here. I just want to make the point that laying everything out and taking an objective look at your situation can be helpful.

Another thing you can do is call all your unsecured creditors (unsecured debt could be your credit cards, student loans, medical debt, personal loans, etc…) and let them know you’re trying to avoid bankruptcy and ask for an interest rate reduction (for credit card debt) or a revised repayment plan (for things such as medical debt) even if it’s only for a year. Secured debt would include a car loan or anything else used as collateral for the loan. I’d recommend that you don’t alarm your secured creditors. We don’t want them taking away your personal property, especially a car.

Key Tip: Keep a record of: Who you spoke to. When you spoke to them. What was discussed? What was the outcome? You’ll find this helpful if you have to make multiple attempts. Also, if you do end up having to go through the legal process of filing for bankruptcy, you can show the bankruptcy judge all the attempts you made to find an alternative.

Homeowners facing negative cash flow should consider consulting with a qualified mortgage professional familiar with bankruptcy law or different types of bankruptcy. An experienced loan officer can provide an objective assessment of their finances and explore options, such as mortgage restructuring, that may help avoid bankruptcy. If you caught this early in the process and your credit still looks good, you may be able to secure a debt consolidation loan in include most, if not all, of your outstanding debts.

When considering bankruptcy as the only viable option, it is important to seek out reputable professionals, such as a bankruptcy attorney that can coach you on what types of debt can be included and what type of bankruptcy would work best for your particular situation. They will also walk you through the bankruptcy procedures, including how to prepare for the bankruptcy courts.

Be sure to tell the bankruptcy attorney what monthly payments you would be comfortable making, going forward and what secured debt you want or don’t want included. Be aware that there will be attorney fees and filing fees. While they can be intimidating, consumer bankruptcy filings are not that complicated.

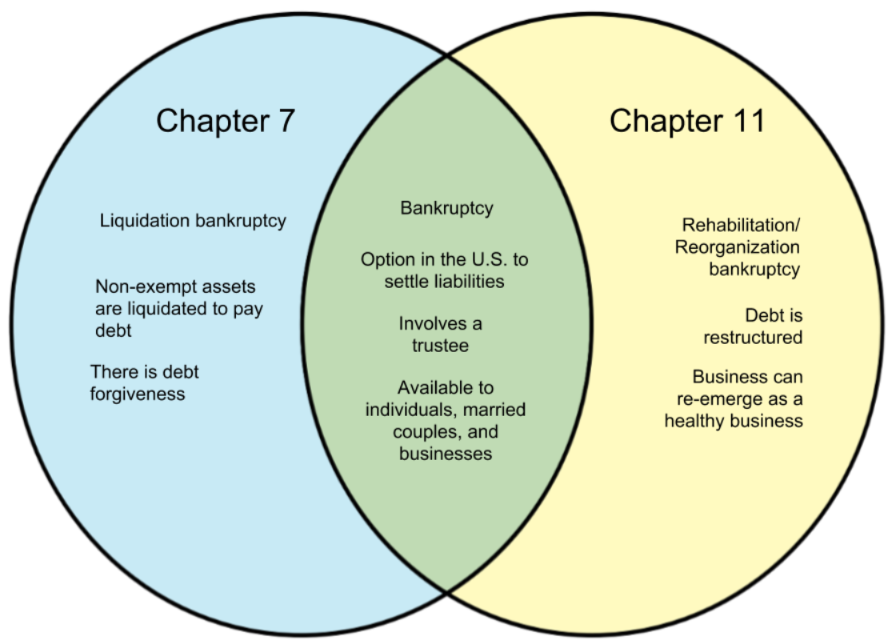

If you’re a business owner in financial distress, you would most likely need to file a bankruptcy under Chapter 11 or corporate bankruptcy. I’m often asked if federal student loans or tax debt be included in some forms of bankruptcy. The short answer is “Maybe”. Getting bankruptcy relief from these financial obligations is possible under certain circumstances, but difficult. This is where a good bankruptcy attorney can be a huge asset.

A qualified mortgage specialist can also provide valuable references, as they regularly work with these professionals. Collaborating with experienced experts significantly enhances the chances of a successful bankruptcy process.

Honesty and accuracy are vital during the bankruptcy process. It is crucial to provide truthful information about one’s financial situation, including any changes in income that may occur. Federal bankruptcy law governs bankruptcy proceedings and is overseen by bankruptcy judges in coordination with various governmental agencies.

What To Do, Post-Bankruptcy.

Upon the conclusion of the bankruptcy process, it is recommended to save and organize all paperwork. This will be helpful post-bankruptcy, as it ensures all necessary information is easily accessible. Mortgage lenders will ask for the entire bankruptcy package, so keep it intact. It is also important to remember to document the discharge date for future reference, as this detail is often forgotten but crucial.

Creating a new household budget is important during bankruptcy. There are affordable computer programs to help. It’s recommended to live below your means and save money during bankruptcy. Saving prepares for future financial needs. I’ve said this before, in other posts, but it’s worth repeating: Regardless if you get it before or after bankruptcy, I highly recommend investing in the Money Max Account (MMA) computer program to get out of debt and build wealth. Full Disclosure: I am paid an affiliate fee but would still highly recommend it even if I wasn’t. It is the most comprehensive program I’ve seen in my 40 years in the lending profession.

During the bankruptcy process, individuals may receive a large amount of unsolicited mail from lenders looking to take advantage of those seeking credit. It is important to stay vigilant and avoid getting caught in new financial pitfalls. These companies hope to exploit the fact that you may be desperate and not thinking rationally.

Rebuilding credit after bankruptcy necessitates a dedicated investment of time and effort, but it is entirely achievable. Some crucial strategies for credit recovery may include:

- Acquiring a pre-owned vehicle focused on transportation within a specified budget and obtaining financing for it.

- To rebuild credit responsibly, get a secured credit card. Deposit money into an account to set the spending limit. Missing payments will deduct from the account. Responsible borrowers may get a higher limit or switch to a regular credit card. Be cautious of offers for “easy credit” or cards that require calling a 900 number, as they may have charges.

- There are several other credit-building tips within this blog.

After bankruptcy, it is possible to restore life and credit, and some mortgage lenders may be willing to lend to individuals within a year (most are after 2 years). Seeking help and advice from reliable professionals is crucial in navigating this challenging time successfully. Please reach out to me if I can be of assistance.