Credit utilization is one of the five major characteristics that make up your credit score which, of course, affects various aspects of your financial life such as loan rates, rental applications, and employment decisions. Credit utilization also happens to be one of the quickest ways that you can improve your credit scores. So, if you’re wondering how credit utilization affects your credit score and what you can do about it, let’s dig in.

Understanding Credit Utilization

Credit utilization is the measurement of the balances on your credit cards and loan accounts in relation to their credit limits. It is determined by dividing your total outstanding revolving credit card balances by the total credit limit offered on your accounts.

The resulting percentage gives the credit bureaus an idea of what your cash flow is; what your spending habits are and what your debt management skills are. The higher utilization percentage indicates a higher level of credit risk. It is generally more beneficial to have a lower credit utilization rate in order to maintain a better credit score.

How credit utilization affects your credit score.

Credit utilization significantly affects your credit score as it provides information about your spending patterns and ability to manage debt.

A high credit utilization signifies heavy reliance on credit, which lenders perceive as financially risky behavior. For instance, maintaining a credit utilization of 80% would result in a significantly lower credit score compared to keeping it around 30%.

Typically, a credit utilization rate below 30% is considered ideal. However, reducing your credit utilization as much as possible will have the greatest positive effect on your credit score.

Optimal Credit Utilization

It is recommended to maintain a low credit utilization, ideally below 10%. Although utilization rates up to 30% are still considered favorable.

Lenders generally view it favorably when consumers utilize only a small portion of their available credit, as it indicates strong debt management abilities and a lower level of risk.

Maintaining a low credit utilization ratio shows that you are capable of responsibly handling the credit given to you. This tends to result in credit card issuers “rewarding” your behavior with credit allowance increases.

Here are some tips for effectively managing credit card balances.

Here are some tips for effectively managing your credit card balances to optimize credit utilization.

- It is recommended to timely and fully pay your credit card bills each month to avoid interest charges or keep balances to a minimum.

- Create a budget to track credit card spending and prevent overspending.

- To reduce your utilization faster, it is recommended to pay more than the minimum due if you have balances.

- It is recommended to prioritize paying down credit cards that are nearing their limit in order to lower your overall utilization to avoid hurting your credit score.

- Consider using your debit card in place of your credit card if you are unsure of your ability to repay the new debt in a timely manner.

- Review your monthly statements for errors or fraudulent charges.

Methods for Enhancing Credit Utilization

For individuals with high credit utilization, there are several strategies that can be employed to improve it.

- To decrease your credit utilization ratio, make aggressive payments toward your balances. This article will show you creative ways to do that.

- Requesting a credit limit increase from credit card issuers can help lower your utilization.

- Opening a new credit card can help increase your total available credit and lower your utilization. Just be careful not to add additional debt.

- To minimize the impact on your utilization ratio, consider transferring balances to cards with higher limits. Be mindful of the fees associated with such a move.

Maintaining and monitoring credit utilization for optimal scoring.

It is recommended to regularly check your credit report and scores to monitor your credit utilization over time. A free service such as Credit Karma can help you monitor your credit history and progress. Credit Karma is free because they hope that you’ll take one of their suggested credit card offers as your credit scores continue to improve.

Just because you CAN qualify for something, doesn’t necessarily mean it’s a good idea to accept their offer, so be careful. Also, there are several different credit scoring models, so don’t be surprised if you apply for credit somewhere and find there is a different credit score.

Set goals to reduce your credit balances and optimize your utilization rate. See this article to help with this.

Maintaining low credit utilization should be a long-term practice. By consistently monitoring and managing card balances, one can establish and sustain an excellent credit score.

Conclusion

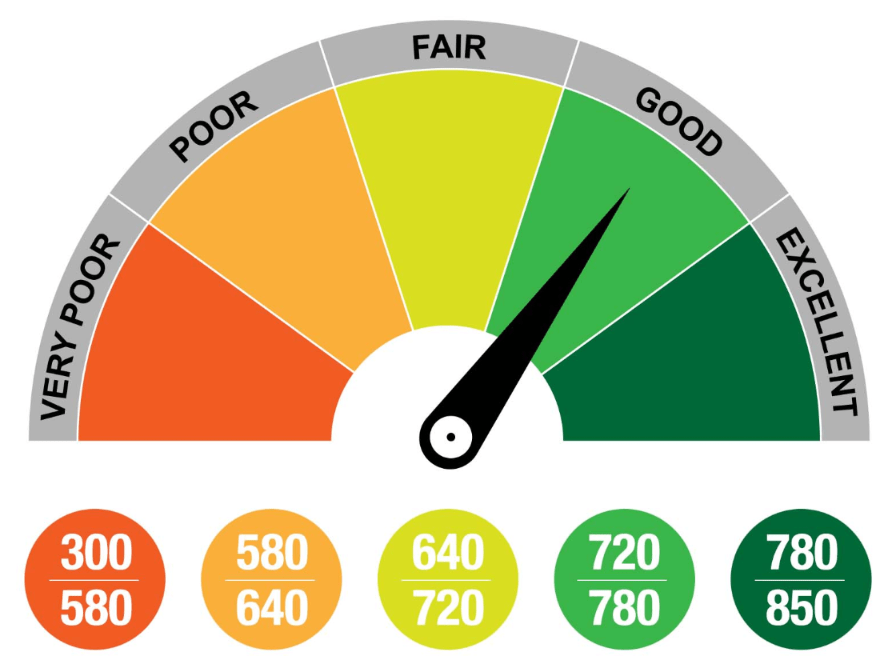

Almost a full third of your credit score is affected by your credit utilization, which is the ratio of your credit card balances to the credit card limits. It is important to keep your utilization rate below 30%, and even better if it is below 10%, to show responsible credit management.

Regularly monitoring your utilization and being strategic about outstanding balances and credit limits can help you effectively manage your credit card debt for better credit scores and financial well-being. Remember to protect your payment history by avoiding the negative impact of late payments. Additionally, a good credit mix of different types of credit, such as installment loans, auto loans, and/or a mortgage will also boost your credit score and prove your creditworthiness.

For help with your credit, click HERE.