Want a 2nd mortgage with no monthly payment? Who wouldn’t? We may have the solution you’re looking for!!

Mortgage Refinance?

So, you’re one of the “lucky ones” who secured a first mortgage with an interest rate under 4%. But, now with high inflation money is getting tight or you’re just looking for some extra cash to do some home improvements. What should you do?

Well, you could refinance your mortgage but with today’s rates in the 7% range that wouldn’t make sense. Or would it? If you’ve accumulated personal or business debt with interest rates in double figures, then your blended rate may be higher than the current 7% interest on first mortgages.

What’s a blended interest rate?

A blended interest rate is when you add up the rates of interest you are paying on all your debt: Mortgages, credit cards, personal loans, student loans, automobile loans, etc… and weighted based on the balance of each debt. To make it easy for you, here’s a calculator you can use.

The Pros and Cons of Refinancing Your Home Mortgage

Pro –

You can get a relatively attractive, fixed interest rate for longer period of time which can drastically reduce your monthly payment obligations.

Con –

Because it’s a larger loan than a 2nd mortgage or HELOC, the closing costs will be higher.

Second Mortgage or HELOC?

If you don’t want to touch your first mortgage bt still want to access some of your home’s equity to consolidate debt or do some home improvements, you can consider a 2nd mortgage or Home Equity Line of Credit (HELOC). What’s the difference?

A second mortgage typically has a fixed interest rate and set term (i.e. 15 years) whereas a HELOC typically has a variable rate of interest. Don’t automatically assume that because the HELOC rate can adjust (usually monthly) a fixed-rate 2nd mortgage must be better.

Even if the rate of the HELOC is higher than that of a fixed-rate 2nd mortgage, the actual amount of interest you PAY may actually be less. That’s because the HELOC is a line of credit, thus you might only use a small portion or use, repay, and use again your credit line and you only pay interest on whatever has been borrowed.

Pros and Cons of a 2nd Mortgage or HELOC

Pro –

A second mortgage or HELOC is typically much smaller than a first mortgage, therefore the closing costs on these loans are lower.

Con –

Because 2nd mortgages or HELOC’s are more of a risk for lenders (In a foreclosure, the first mortgage must be satisfied before anything is paid on the second mortgage), the interest rates are higher.

A 2nd Mortgage with NO monthly payment at all?

While having no payment at all may sound like a really good option, it’s not an option available to everyone, which is why I’ve listed it last.

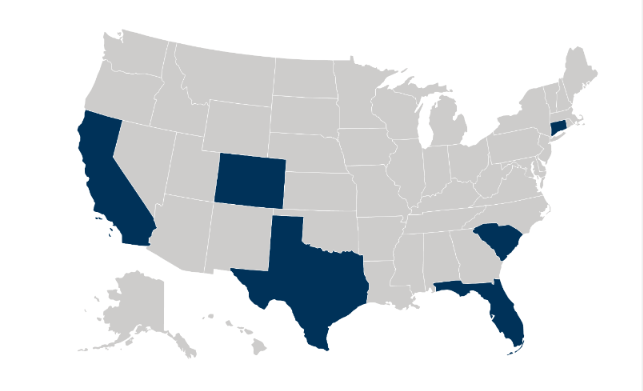

This is a Reverse Second Mortgage and it could be the perfect solution for folks 55 and over who live in California, Colorado, Connecticut, South Carolina, or Texas! (These are the only states that this program is currently available in) Reverse Second Mortgages allow homeowners aged 55 (62 in TX) and older to tap into their home’s equity without having to make any monthly payments.

Clearly, this type of mortgage is different from a regular second mortgage or home equity loan, as it does not require monthly payments and can be used for a variety of purposes.

Understanding Reverse Mortgages

To understand how this 2nd mortgage can have no monthly payment requirement, you need to know a little about how a Reverse Mortgage works. A reverse mortgage is a unique financial instrument that allows homeowners aged 62 (55 for some programs) or older to convert a portion of their home equity into loan proceeds, which are then paid out as a lump sum, monthly payments, a line of credit, or any combination of the three. Unlike traditional mortgages, the homeowner doesn’t make monthly payments. Instead, the loan is repaid when the borrower sells the home, moves out, or passes away.

Reverse Second Mortgage and Home Safe Second:

Just like any other mortgage, a reverse mortgage, or in this case, a reverse 2nd mortgage does have a rate of interest that is charged each month. Except, instead of you making a principal and interest payment each month, the interest is added to the principal balance.

Does this mean that every month, you are losing equity in your home? The answer is yes AND no. Yes, your principal balance goes up but often that “loss” of equity is made up by real estate market appreciation. Obviously, no one can guarantee that home prices will continue to go up.

What if real estate values drop? Can you lose your home to foreclosure? The short answer is “No”. There are safeguards in place that prohibit you from losing your home if your principal balance exceeds the value of your home. You are required, however, to maintain your home and continue to pay the associated real estate taxes and insurance.

What can the funds be used for? The funds received can be utilized for various purposes, including home improvements, debt consolidation, or supplementing retirement income. It’s up to you.

Geographical Considerations

If you are contemplating a reverse mortgage, it’s essential to be aware of regional nuances and regulations. Plus, this program is currently only available in California, Colorado, Connecticut, South Carolina, and Texas, and each may have specific guidelines governing reverse mortgages. Consulting with a qualified financial advisor who understands the local landscape is crucial to navigating the process smoothly.

Benefits of a Reverse 2nd Mortgage:

- No Monthly Payments: The primary advantage is the absence of monthly repayment obligations. This feature can provide financial relief to homeowners on fixed incomes.

- Home Equity Access: Unlock the equity built up in your home, transforming it into a valuable financial resource without having to sell or move.

- Flexible Usage: Utilize the funds for a myriad of purposes, such as home renovations, debt consolidation, or supplementing retirement income.

Conclusion:

A Reverse 2nd Mortgage or Home Safe Second can be a game-changer for homeowners aged 55+ (62+ in TX) seeking to leverage their home equity without the burden of monthly payments.

Remember, before diving into any financial arrangement, it’s crucial to conduct thorough research and seek advice from professionals well-versed in the field of reverse mortgages. Your home is not just a place to live; it’s a valuable asset that can potentially pave the way for a more comfortable and secure future.