Want to pay off your mortgage fast?

Who wouldn’t? But, what if you could do it without increasing your payments or adversely affecting your monthly budget? Introducing the All-in-One Mortgage.

Having been in the mortgage lending profession since 1982, I’ve seen countless families return, time after time to refinance their homes, not for the purpose of reducing their interest rate or term but rather to tap into equity to pay off accumulated consumer debt.

I don’t fault these clients for doing whatever they feel is best for their families. However, it pains me to see that they never seem to get ahead of the debt curve. That is why I’ve tried to steer more of my clients toward programs designed to help them get rid of debt once and for all and yet still have access to their funds in case of an emergency. The All-in-One (AIO) loan program is an excellent option for this purpose.

The all-in-one mortgage is a unique financial product that combines a bank account, mortgage, and home equity line of credit into one comprehensive package. This innovative solution aims to simplify the borrowing process while providing increased flexibility and convenience in managing finances.

With an All-in-One (AIO) mortgage, borrowers have the ability to deposit their income directly into their bank account, which is linked to their mortgage, which is very similar to a home equity line of credit (HELOC). The process of making a typical bank deposit, in this case, acts as a mortgage payment thus reducing the amount of interest that is calculated daily.

One of the key benefits of an All-in-One (AIO) mortgage is that it enables borrowers to pay off their loans quickly while maintaining liquidity for unexpected expenses. Instead of having your income sitting idle in a separate bank account, earning very little interest (if any), 100% of your funds are used to reduce the mortgage balance, ultimately saving on interest costs over the long term.

Moreover, the all-in-one mortgage offers the added advantage of having a home equity line of credit bundled into the product. This allows borrowers to access funds for other purposes, such as home renovations or education expenses, without the need for additional borrowing or applying for a separate line of credit.

In summary, an all-in-one mortgage combines a bank account, mortgage, and home equity line of credit into one comprehensive product. By utilizing the excess funds in the bank account to reduce the mortgage balance, borrowers can pay off their loans quickly while maintaining liquidity for unexpected expenses. This innovative solution offers convenience, flexibility, and potential savings for those seeking a streamlined borrowing experience.

All-In-One Mortgage Vs. Home Equity Line Of Credit

With all this said, how does the AIO differ from the typical HELOC?

The All-in-One (AIO) mortgage and a home equity line of credit (HELOC) are both ways to access the equity in your home, but there are some key differences between the two.

Firstly, one of the main advantages of an All-in-One mortgage is convenience. Unlike a HELOC, which requires a separate loan application and process, the AIO mortgage combines a savings account with the mortgage itself. This means that the mortgage payments you make are deposited directly into the account and can be accessed for withdrawal if needed. This streamlined approach saves borrowers time and avoids the hassle of dealing with multiple applications and processes.

In addition to the convenience factor, the AIO mortgage offers the added benefit of being accessible in any denomination. I’ve often told my clients they can buy a latte with their AIO debit card if they want. In contrast, the typical HELOC requires any withdrawal to be a minimum of $500. This flexibility with the AIO allows consumers to truly use their bank/mortgage funds as they wish. It makes saving interest that much easier because consumers don’t have to preplan or rearrange their spending habits.

Another HUGE difference between the AIO mortgage and a HELOC is that the line of credit on the AIO is available for the full term of the mortgage. In contrast, HELOC’s typically have a 3, 5, 7 or 10-year access. After that, the HELOC becomes a closed-end loan, just like any other mortgage. Having access to your home’s equity for the full 30 years gives you ample opportunity to utilize those funds for investments, unexpected emergencies, vacations, charitable events or whatever you’d like.

Furthermore, an all-in-one mortgage provides easy access to equity. Borrowers can tap into their equity by simply withdrawing funds from the integrated checking account without having to go through a separate loan approval process. They can write a check, use a debit card, make an electronic transfer or even utilize services such as Zelle or Venmo.

With the ease of access to their equity for the full term, the All-in-One mortgage can quite possibly be the last mortgage a consumer would need which saves clients thousands in refinance fees! Instead of having to refinance to access equity, borrowers can simply withdraw the funds from the combined checking account.

In summary, an All-in-One mortgage offers the convenience of not requiring a separate loan application or process, in addition to the convenience of accessing their funds in any amount at any time for the entire duration of the term of the mortgage. Just this alone makes the AIO a fantastic loan program. When you add in the benefit of paying off your mortgage faster by reducing the amount of interest paid, this program is a great choice for consumers who qualify for the program.

Disadvantages of an All-In-One Mortgage

We’ve talked a lot about the advantages and benefits of the AIO mortgage. What are the disadvantages?

One disadvantage is that the AIO mortgage program qualifications are more stringent than most other mortgage loan programs. First, it requires that the potential borrower has at least a 700 credit score, whereas other conventional loans can go as low at 620 and FHA loans as low as 500.

Another qualification is that the borrower has to be “cash-flow positive”, meaning that their income exceeds their expenses and has to fall under a 41% debt-to-income ratio.

The third major qualification is that the borrower must already have the ability to save money by showing evidence of liquid assets equal to at least 10% of the proposed loan amount. This means that if someone is applying for a $300,000 AIO mortgage, they must be able to show liquid assets (which can include retirement savings) equal to at least $30,000 in order to qualify for this loan program.

While these strict qualifications may appear to be a disadvantage, they are really intended to help ensure the success of the loan program for the consumer. You don’t want to give someone a Ferrari that doesn’t know how to drive.

Another possible disadvantage would be that the AIO mortgage is not a fixed-rate mortgage. Instead, it is tied to the CMT (Constant Maturity Treasury) index. This would only be a “disadvantage” if you insist on a fixed-rate mortgage. However, once you learn about the program and understand that the interest rate is only a part of the mathematical equation that makes up the actual amount of interest you pay, you’ll see that it doesn’t matter what the interest rate does from month to month.

And, lastly, one potential downside of the All-in-One mortgage is the ease of overspending. With the ability to access funds easily and conveniently, some homeowners may be tempted to overspend, leading to increased debt.

Examples of All-in-One Mortgages

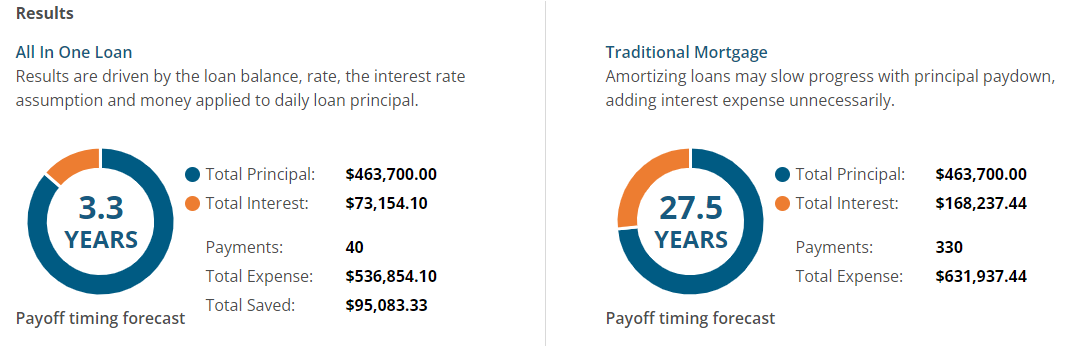

In the example below, you can see that my client knocked 24 years off his mortgage while also reducing his average monthly payment by almost $100.

Just as with investments, results will vary from one person to another because there are many variables. The purpose of this article is to introduce the concept of the All in One loan program so that you can decide if it might be a good fit for you and your family. Feel free to reach out to me if you have any questions.

Related Topics:

The Best Way to Leverage Your Way to Wealth

What’s more important: The interest rate of the amount of interest paid?