How to Rebuild Your Credit & Raise Your Credit Scores

If you are looking to improve your credit score, here are some great strategies you can utilize right away to give your score a little boost.

Secured Credit Card:

If you’re just starting out or have had a significant credit adversity, such as a foreclosure or bankruptcy, a good way to start the rebuilding process is with Secured Credit Cards. These secured cards are Visa or MasterCard credit cards issued by your local banks or credit unions. The “credit limit” on these cards (usually around $500) is based on the amount of funds that you place into an account with that bank/credit union as collateral.

I’d recommend having no less and no more than 3 credit cards. Use them every month and, if you can, pay them off before the next due date. If you cannot pay them off right away, be sure to keep the balances under 30% of the “limit” to prove your ability to manage your finances correctly.

Create Some Balance:

While paying down installment debt (car, school, mortgage, etc.) will definitely boost your credit score, paying down or paying off revolving debt, such as credit cards, can cause a quick jump in your credit score. The trick is to get and keep your balances below 30% of your credit limit on each card. Don’t get me wrong, a good credit mix (i.e. car loans, mortgages, etc..) can help build a positive credit history.

For faster results, attack those cards with balances closer to their respective credit limits first, as opposed to those cards with simply the highest debt. Remember, if you pay off any credit cards completely, do not close your accounts without discussing it with your mortgage professional first. Canceling those cards may inadvertently undo all of your hard work.

Know Your Limits:

Make sure that your credit card companies are reporting the correct credit card limits on your accounts to the three major credit bureaus. Without an available limit, your account will appear to be maxed out at its highest reported balance each month. This could cost you up to 80 points in certain instances. Your credit utilization ratio makes up roughly 30% of your credit score, so this is something you want to watch for.

What this would like on your credit report – Let’s say you’ve been approved for a credit card with a $5,000 limit and your highest charged balance on this card is $2317. If the credit card issuer does not report your limit (i.e. $5,000), then the report will show: “Limit: $2317 Highest Balance: $2317”. It shows the highest charged amount as the “limit” which makes it look like you maxed your credit.

Some creditors, such as American Express® and certain cards issued by Capital One®, actually have a policy of not reporting available credit. However, most companies will report your credit limits if you ask them in writing.

Take Some Credit:

If you have a credit card account in very good standing, make sure that all three credit bureaus know about it. Just like your credit limits, some creditors don’t report your information to all three credit companies – this is one of the reasons why credit scores often vary between bureaus. If this is the case, give them a call to find out why. Correcting this oversight could provide a significant boost to your score and provide you with a better credit profile.

Also, if you’re in very good standing, ask your creditor for a lower rate or higher credit limit. This will increase the gap in the debt you owe versus the credit you have available. Sometimes hinting about closing an account can suddenly bring out the generous spirit of certain card issuers. Give it a try. The worst they can say is no.

Protect Your Interests:

Your credit is calculated based solely on the information available to your creditors. If you have a HELOC, make sure it’s listed as a mortgage or an installment account on your credit reports and not a revolving debt. If you had a bankruptcy, be sure that all items associated with the bankruptcy are being reported correctly, that is with a zero balance. This action could increase your score by 50-100 points. Because simple mistakes like these can wreak havoc on your credit score, it’s important to monitor your credit every four to six months.

Over the years, I’ve seen hundreds of cases where creditors who were discharged in bankruptcy incorrectly place an open collection or charge-off on a credit report with the hope they will eventually be paid by an unsuspecting consumer who doesn’t remember having that debt discharged.

Even the Score:

If you find information on your credit report that you believe is inaccurate or incomplete, then you have the right to dispute it free of charge. For the fastest results, visit the appropriate credit bureau’s website and file a complaint online. If supporting documents are necessary, you may have to file your dispute by mail.

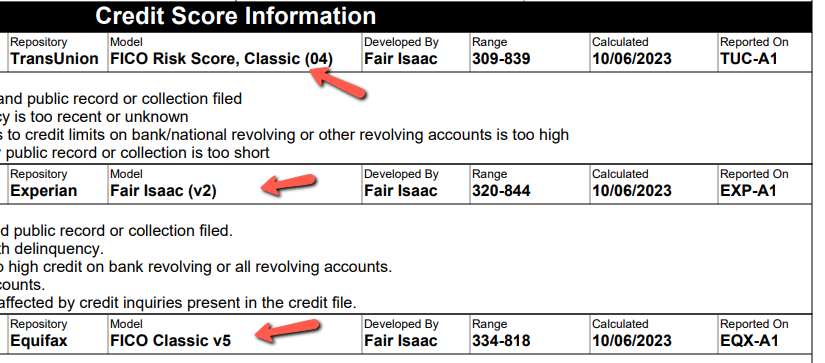

Don’t forget that you can access your credit record absolutely free by going to AnnualCreditReport.com. You only get one free report from each bureau per year, so I would suggest pulling one bureau in April, another in August, and the third in December. Although they will vary (because they have different scoring models), it will still give you an idea of what is being placed on your credit profile.

Graphic showing TransUnion, Experian, and Equifax all use different credit-scoring models.

You can access a free sample Dispute Letter here. I am not an attorney, so none of this should be taken as legal advice. However, I have been a mortgage lender for roughly 40 years, so I know my way around a credit report. So, if you or anyone you know has any questions about credit scores or what can be done to repair them, please don’t hesitate to reach out.

For help with your credit, click HERE.