If you’re considering investment properties to help reach your financial goals, it’s important to have a solid foundation to build your strategy on. This starts with establishing good credit and saving liquid assets.

While it’s not a requirement, I recommend starting with the purchase of your own single-family home. However, if you prefer, you can jump right into investment properties. The best route for you may depend on your available assets. Keep in mind that a primary residence typically requires a lower down payment than an investment property. If you’re a veteran, you may be able to purchase your primary residence with no down payment at all. If you’re not a veteran, you may still qualify for a down payment assistance program.

In addition to good credit and funds for a down payment, investors need to show sufficient cash flow to prove they can handle the financial obligations if there is a lapse of monthly income from the property. Lenders typically build in a 25% vacancy factor into their calculations.

![]() What if you can’t show sufficient cash flow?

What if you can’t show sufficient cash flow?

Luckily, there is a loan program that makes this process easier for would-be real estate investors. It’s called Debt Service Covered Ratio (DSCR), and it allows investors to qualify for a mortgage based solely on the rents of the subject property. This means that you don’t need to provide the lender with pay stubs, W2’s, 1099’s, tax returns, or profit & loss statements!

Even if you already have sufficient cash flow, the DSCR program streamlines the documentation of the file making for a more pleasant transaction and quicker closing.

“How much can I afford?”

Because there are no Debt-to-income (DTI) calculations on a DSCR, your affordability is only limited by the amount of down payment you are able to provide. You should also consider the cash-flow impact that an investment property mortgage payment would have if you were to go without rental income for a few months.

To qualify for the DSCR program, you need a credit score of at least 620, a 15% to 35% down payment (depending on your credit score and if you’re a first-time real estate investor), and the subject property rents must cover at least 75% of the new mortgage payment. If you meet these requirements, you may be on your way to building your investment property portfolio.

How to Start Investing in Rental Properties — Your Step-by-Step Guide.

Now that you have an idea of how the DSCR works, here is a step-by-step guide to help you start investing in rental properties:

1. Establish your budget: Determine what you can realistically afford, as noted above, and set a budget for the property.

2. Review your financing options: Once you’ve determined what you can comfortably afford to invest, look into financing options including traditional mortgages and non-QM mortgages, such as the previously discussed DSCR loan. Make sure you understand all fees associated with borrowing money and the documentation requirements.

3. Gather your documentation: You’ll improve your odds of a successful closing, not to mention reduce paperwork headaches, by preparing your documentation before you even need it. This can include:

- Drivers’ license

- Tax returns and/or W2’s for the past two years

- Bank statements (for any assets you plan to disclose) for the past two months (all pages)

- Pay stubs (if applicable) covering the most current one full month

4. Search for properties that have good cash flow, potential appreciation, and meet other criteria you’ve set for yourself. Consider enlisting the help of a real estate professional to help you find investment properties in your area.

5. Analyze & evaluate: Carefully review financial statements provided by the Seller. Consider any necessary repairs needed before renting out the unit, and factor in property taxes, homeowners insurance, and association fees when calculating potential profits from the investment property. Review local landlord-tenant laws. A good property management company that understands the local real estate market is a good resource for this.

6. Finalize purchase: After analyzing data from the rental market in your area and comparing it to comparable rental units in other neighborhoods, negotiate the purchase price on the property if it meets your criteria, fits within your budget and satisfies your return on investment goal.

7. Manage & maintain: Make sure that everything is up to code so that you are not liable for any injuries or damages caused by negligence or poor maintenance of the property; hire a team of professionals such as an accountant, attorney, or property manager, if needed; monitor rent payments closely; keep records of all expenses related to maintaining the rental; keep abreast of local landlord-tenant laws; and communicate regularly with tenants about their concerns or feedback regarding their living conditions or rental rates increases/decreases over time.

Key Tip: When working with tenants, instead of imposing a penalty for late payments, raise your rents to where it would be if a penalty was imposed, then, offer a “discount” for rents paid on time. This helps keep things positive. Plus, it can be helpful if you would ever need to go to court.

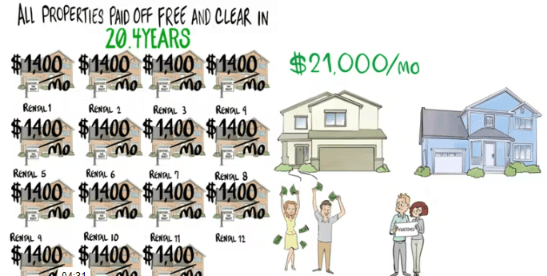

8. Get out of debt! You may not hear this from other advisors but I’m a firm believer in being debt-free. As an investor, you’ll have plenty of other expenses that you can use as write-offs against your income. Being debt-free just gives you that peace of mind of knowing that if things get bad, you’ll be fine. To accomplish this effectively, I would highly recommend employing the All-in-One loan program. If you’re not familiar with this loan, I’ll be happy to discuss it with you. Another very good option is the use of a computer program called the Money Max Account (MMA). Both of these options will help you get out of debt and help you plan for your next investment property; and then the next, then the next, etc…

By following this step-by-step guide and having a clear understanding of the basic principles of rental real estate, new investors can set themselves up for success in the rental property market. Remember to continually educate yourself and adapt your investment strategies based on market trends and individual goals.

The 1% Rule For Investment Properties

The 1% rule is an important guideline to keep in mind when considering a potential property investment. This qualitative factor suggests that for an investment to be profitable, the rental income generated should equal or exceed 1% of the mortgage amount. For example, if a property’s mortgage was $100,000, then it would have to generate at least $1,000 in rent each month for it to be considered a viable investment. It’s important to know the local market and compare similar properties as this will help determine if a 1% return is reasonable or not.

When researching potential investments, understanding and following the 1% rule can save time and trouble down the line. Applying this simple rule of thumb will go a long way toward ensuring the overall success of any property investment venture.

Risks and Rewards of Owning Rental Property

Investing in rental properties can offer both risks and rewards for beginners. On the one hand, rental properties can be a great source of passive income and tax benefits. By purchasing a property and renting it out, investors can earn a steady stream of rental income every month. This income can help supplement their regular income or serve as a primary source of money. Furthermore, rental properties have the potential to appreciate in value over time.

However, it is important for beginners to be aware of the risks involved in rental property investing. One of the main risks is the property maintenance costs associated with owning a property. Landlords are responsible for maintaining the property and covering any repairs or damages. These costs can sometimes eat into the rental income and reduce overall profitability.

Additionally, there is a risk of tenants not paying their rent on time or at all which is why you need to review and understand your legal rights as a landlord BEFORE buying your property. It is crucial for investors to thoroughly screen potential tenants and have a plan in place for dealing with non-payment situations.

Buying a Vacation Rental Property

Buying a vacation rental property can be an exciting investment opportunity, but it’s not without its considerations and challenges. One of the main factors to consider is the need for high rental rates to offset periods of low occupancy. Unlike long-term rental properties, vacation rentals often experience fluctuations in demand, especially during off-peak seasons. Higher per-night rental rates are necessary to ensure a healthy investment cash flow.

Another challenge with vacation rental properties is the higher expenses associated with managing them. Advertising and marketing costs are typically higher since you need to reach a broader audience of potential vacationers. Additionally, maintenance and cleaning expenses are more frequent and costlier due to the wear and tear that comes with frequent turnovers of guests.

Insurance is also an important consideration for vacation rentals. Since you will be renting your property to strangers, it’s crucial to have the right coverage to protect against any potential damages or liability issues that may arise during a guest’s stay.

Despite these challenges, buying a vacation rental property can offer potential benefits, such as the opportunity for higher rental income and the potential for personal use during periods of low demand. Consulting with a real estate professional who specializes in vacation rental properties can help you navigate the unique aspects of this type of investment.

REIT: Real Estate Investment Trusts

If the thought of dealing with renters or broken pipes associated with rental property ownership concerns you, perhaps a REIT is your answer to a properly structured real estate investing strategy. Real Estate Investment Trusts (REITs) are similar to mutual funds but made up of companies that own, operate, and finance income-producing real estate. By purchasing shares in publicly traded REITs, investors can tap into the potential benefits of real estate investing while enjoying the ease and diversification of a typical stock market investment.

One of the primary advantages of REIT investing is the opportunity to generate passive income through dividends. As mandated by law, REITs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends. This means that investors can receive regular income streams from the rental income of the properties owned by the REITs.

Furthermore, REIT investing provides an avenue for diversification. By investing in shares of multiple REITs, investors can spread their risk across different types of properties, geographical locations, and property sectors. This helps to mitigate the risks associated with relying on a single investment property.

In conclusion, REIT investing offers a beginner-friendly approach to real estate investment. By purchasing shares in publicly traded REITs, investors can benefit from the potential income-generating properties of real estate, as well as the ease and diversification provided by the stock market. Whether you’re seeking passive income or looking to diversify your investment portfolio, REIT investing is certainly worth considering.

Get Help.

Seeking the advice of qualified professionals in the areas of real estate investing, managing, rehabbing, and maintenance is essential. You should also surround yourself with the most qualified real estate attorneys, accountants, insurance, and mortgage lenders. Having a team of professionals on your side will make the entire process easier, more enjoyable, and more profitable.