Reverse Mortgages Not Just For Cash-Strapped Seniors

Some seniors mistakenly believe that reverse mortgages are only for those with inadequate retirement income. However, reverse mortgages can be beneficial for both cash-strapped seniors and those with sufficient incomes. In fact, many will utilize a reverse mortgage loan to allow them to delay receiving social security or delay withdrawal from a retirement account to improve their respective financial outcomes.

Reverse Mortgage Line of Credit

One reason why seniors should consider a reverse mortgage is the line of credit (LOC) option available in a Home Equity Conversion Mortgage (HECM), which is a government-insured type of reverse mortgage. The LOC offers guaranteed growth, access to funds, and acts as a safeguard against inflation and decreasing local property values.

The reverse mortgage line of credit is becoming increasingly popular due to its flexibility and potential financial benefits to borrowers. According to an AARP article, 66% of those seeking a reverse mortgage recognized the credit line option as the right choice for them. This type of loan allows borrowers the freedom to access funds up to the maximum allowed by HUD in the first 12 months and then withdraw funds as desired beyond that. The fact that homeowners can take all available remaining funds after 12 months if they wish, but are not required to take any if unnecessary is a major benefit that keeps this option in high demand.

More Popular Than The Fixed Rate

A frequently asked question when considering this option is why it’s more popular than the fixed rate program since it comes with an adjustable interest rate. The increased flexibility appeal combined with a great starting cost for monthly payments makes the variable rate Reverse Mortgage Line of Credit more attractive than other types of loans. Payment options can include a lump sum payment, regular monthly withdrawals, a line of credit or just about any combination of these options. Before deciding on an option or even if a reverse mortgage is right for them, borrowers should seek the counsel of a knowledgeable financial advisor or Reverse Mortgage Counselor. In fact, it’s a requirement that borrowers must meet with a HUD-Approved Counseling Agency before proceeding.

Guaranteed Growth Rate Feature

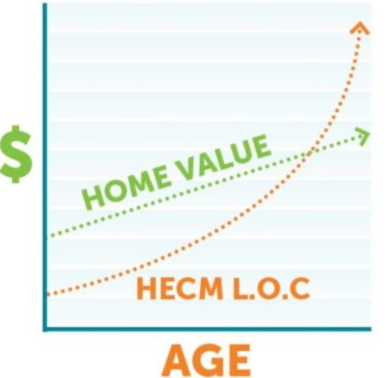

The growth rate of a line of credit reverse mortgage is an important factor for borrowers to consider. Unlike interest earned on a bank account, the unused portion of the credit line increases at the same rate as the loan accrues interest and Mortgage Insurance Premium (MIP) renewal. This allows borrowers to access more funds in the future by borrowing against their home’s equity while still maintaining control over their payment plans.

As an example, a senior couple, both aged 64, own a home valued at $150,000 with no outstanding mortgage balance. They can qualify for an initial credit line of $69,580 through the HECm reverse mortgage. The credit line will grow at a rate above 7% (currently 7.28% as of 3/7/23) and changes monthly. Assuming no withdrawals are made, in 20 years the credit line will be worth $283,825. Additionally, if their home appreciates at an average rate of 3%, it will be worth $270,917 in 20 years, which is almost $13,000 less than the credit line.

Accessible Funds

Having access to money is preferable to not having access to it. In the previous example, if the senior couple didn’t get a HECM reverse mortgage, they would have to rely on their savings and investments for unexpected expenses medical expenses or expensive life events like home health care, assisted living, or nursing home care. To access the money tied up in their home, they would need to sell the property, which could take months, or get a regular mortgage, which creates an additional financial burden.

Seniors face the risk of losing purchasing power during their retirement due to inflation and decreasing property values. Inflation causes prices to rise, eroding purchasing power. The line of credit with guaranteed growth can serve as a hedge against inflation. Additionally, seniors may find that their homes do not appreciate as much as others in the real estate market due to outdated styles and features. In this case, the LOC’s guaranteed growth can provide a valuable risk reducer, surpassing the value of the home itself.

How Does a Reverse Mortgage Line of Credit Work?

A reverse mortgage line of credit works just like any other type of revolving line of credit. You can borrow as you please, pay it back, and use again as you see fit. However, unlike a regular HELOC or credit card which often has minimum payments due every month, a reverse mortgage line of credit doesn’t have this requirement. FHA-insured reverse mortgages not only have no minimum payment requirements but they also cannot be frozen or canceled because of market conditions. This makes them ideal for accessing your equity quickly while avoiding the burden of regular payments that may come with other financial products.

Ultimately, a reverse mortgage line of credit is an attractive option for retirees who want a flexible source of additional funds without having to worry about increasing financial obligations. It provides access to your home’s equity that can provide security and peace of mind, and can be especially valuable when there are no other options available. Although it comes with all the same closing costs as traditional loans, for many people it is worth paying some fees in exchange for the flexibility and peace of mind that these lines of credit offer.

Reverse Mortgage Line of Credit vs. Home Equity Line of Credit (HELOC)

A home equity line of credit (HELOC) is a type of loan in which the borrower uses the equity in their home as collateral. Unlike HECMs (Home Equity Conversion Mortgages), HELOCs can be obtained on any property that’s owned, regardless of primary residence status or age requirements. As a revolving line of credit, this type of loan acts more like a credit card: you’ll draw from it when needed and make periodic interest payments during the draw period. This draw period eventually ends with an agreed-upon timeline (usually 5 to 10 years) where payments are made for both principal and interest owed during the repayment period, at which time it becomes a closed-end loan.

HELOCs offer homeowners flexibility in that they have access to funds quickly without having to go through unnecessary paperwork. Additionally, as long as payments are kept up-to-date, you may also be able to qualify for lower interest rates. However, since it’s typically unsecured debt, banks will likely require strict qualification criteria before approval is granted; borrowers should prepare to disclose relevant financial documents for review. Overall, HELOCs provide an effective option for leveraging existing equity in order to meet personal financing needs without cutting back on necessary expenditures.

In comparison to the HELOC, reverse mortgages come with a number of advantages that make them an appealing option for persons over the age of 62 (some programs can start as early as age 55). For instance, they require no monthly payments and provide the borrower with access to their home’s equity without having to sell it.

In conclusion, both HELOCs and reverse mortgages have their own set of benefits and drawbacks depending on a person’s individual situation. However, for those over the age of 62, reverse mortgages can be an excellent way to access additional funds without having to worry about making monthly payments as well as a hedge against inflation.

Reverse Mortgage Requirements

Reverse mortgages are an increasingly popular financial product for those over age 62 that own their home. While they can offer some great benefits, it’s important to understand all the eligibility requirements before signing up for one. The most obvious of these is that the primary homeowner must be age 62 or older – though a very small number of lenders may offer such loans with homeowners ages at 55.

In addition, there are various other conditions you need to fulfill to be eligible. For example, you must own your home outright or have paid down at least half of your mortgage, and it must be the property you primarily occupy. Moreover, no delinquency on any federal debt is accepted. While there is no stringent income requirement, a financial assessment is made to determine your capability to pay ongoing bills such as property taxes, homeowners insurance premiums, and property maintenance costs. Taking all these criteria into consideration is essential in order to avoid any potential issues later on in the process.

If this leaves you with more questions than answers, please feel free to reach out to me directly.