Didn’t quite qualify for the best Reverse Mortgage that meets your needs? We may have a solution!

What Is A Reverse Mortgage?

A reverse mortgage is a type of loan available to homeowners aged 62 or older (age 55 for some programs) that allows them to convert part of their home equity into cash. The three main types of reverse mortgages include Home Equity Conversion Mortgages (HECMs), proprietary reverse mortgages, and single-purpose reverse mortgages.

HECMs are the most common type of reverse mortgage and are insured by the Federal Housing Administration (FHA). They offer the most flexibility and can be used for any purpose. Proprietary reverse mortgages are private loans backed by the companies that develop them and are typically available to homeowners with high-value homes. Single-purpose reverse mortgages are offered by state and local government agencies and are typically used for a specific purpose that must be approved by the lender, such as home repairs or property taxes.

The main difference between these types of reverse mortgages is their eligibility requirements and loan features. HECMs have more flexible eligibility requirements, while proprietary and single-purpose reverse mortgages may have stricter criteria. Additionally, HECMs offer more flexibility in how the loan proceeds can be used, while proprietary and single-purpose reverse mortgages may have specific restrictions.

Pros And Cons Of A Reverse Mortgage

A reverse mortgage is a financial tool specifically designed for homeowners aged 62 and older (55 years for some programs). It allows them to convert a portion of their home equity into cash without having to sell their home or take on a new monthly mortgage payment. This can be a valuable option for seniors looking to supplement or delay their retirement income, make home improvements, or cover unexpected expenses. However, it also comes with its own set of drawbacks and potential risks that need to be carefully considered before deciding to proceed. It’s important to weigh the pros and cons of a reverse mortgage to determine if it is the right choice for your financial situation.

Pros

One of the main advantages of getting a reverse mortgage is the elimination of monthly mortgage payments. This can greatly reduce financial stress for retirees on a fixed income. Additionally, a reverse mortgage can be used for debt consolidation, allowing homeowners to pay off high-interest debt and lower their monthly expenses. Furthermore, the funds from a reverse mortgage can be used for home improvements, allowing homeowners to age in place and increase the value of their property.

The additional income from a reverse mortgage can also supplement retirement income, providing more financial security in the golden years. Lastly, a reverse mortgage can be used to increase savings by tapping into the equity of the home. These benefits can help address individual financial needs and goals by providing financial flexibility, reducing financial burdens, and increasing overall financial security in retirement. Overall, a reverse mortgage can be a valuable tool for homeowners looking to improve their financial situation in retirement.

Cons

One major drawback of a reverse mortgage is the higher costs associated with it. These costs include application fees, closing costs, and mortgage insurance premiums, which can significantly reduce the amount of money received from the loan. Additionally, when the house is eventually sold, the profit is often reduced due to the accumulated interest and fees on the reverse mortgage.

There is also a minimum equity requirement for a reverse mortgage, which means that the homeowner must have a certain amount of equity in their home to qualify. Furthermore, reverse mortgages can be complex and vulnerable to financial scams targeting seniors. Seniors may be persuaded to enter into agreements that are not in their best interest, leading to financial exploitation and loss of equity in their homes.

In conclusion, while a reverse mortgage can provide financial support for seniors, the drawbacks, including higher costs, reduced profit, equity requirements, and susceptibility to financial scams, should be carefully considered before pursuing this option.

Are you a good candidate for a reverse mortgage?

A good candidate for a reverse mortgage is someone who has a substantial amount of home equity, limited retirement income, and a preference to not leave the house to heirs. However, those same heirs may be relieved to learn that the additional financial resources from a reverse mortgage can help with the financial burden associated with caring for their parents. These factors make a reverse mortgage a viable option for supplementing their income during retirement without having to sell their home.

It is important for individuals considering a reverse mortgage to also explore alternative options to ensure they make an informed decision about their financial future. This may include looking into downsizing (selling their home), seeking financial assistance programs, or exploring other types of home equity loans.

What if you don’t have enough equity for a Reverse Mortgage?

If you don’t have enough equity for a reverse mortgage, there are alternative options to tap into your home equity. One option is a home equity loan, which is a lump sum loan secured by the equity in your home. Another alternative is a home equity line of credit (HELOC), which is a revolving line of credit that allows you to borrow against the equity in your home as needed. Additionally, you could consider refinancing your mortgage with better loan terms to access the equity in your home.

When evaluating these alternatives, it’s important to compare the fees and payment structures to determine the best option for your financial situation. Home equity loans and HELOCs may have lower upfront costs, but they also come with variable interest rates and potential payment fluctuations. Refinancing may offer a fixed interest rate and lower overall costs, but it could also reset the payment term on your mortgage.

Keep in mind that, unlike a reverse mortgage, these aforementioned options would require monthly repayments. Before pursuing any of these options, it’s crucial to carefully consider your long-term financial needs and consult with a financial advisor to determine the best course of action for tapping into your home equity.

Introducing the Equity Avail Reverse Mortgage

The Equity Avail Reverse Mortgage offers a unique solution for homeowners looking to ease the financial burden of a traditional mortgage but doesn’t have the equity needed to qualify for a standard reverse mortgage.

The Equity Avail reverse mortgage can significantly reduce your mortgage payment burden by upwards of 70% or more for the first 10 years of the term. Beginning with year 11, the program rolls automatically into a traditional reverse mortgage with no mortgage payment.

Equity Avail is the ideal program for someone over the age of 55 looking to reduce work hours and financial stress. There is no expensive FHA insurance required and it’s a non-recourse loan, so you don’t have to worry about what might happen if the home values drop.

To qualify, the homeowner must be at least 55 years of age with a credit score of at least 680. They must have at least 10 years remaining on their current mortgage and agree to maintain the property and continue making timely payments on real estate taxes and insurance.

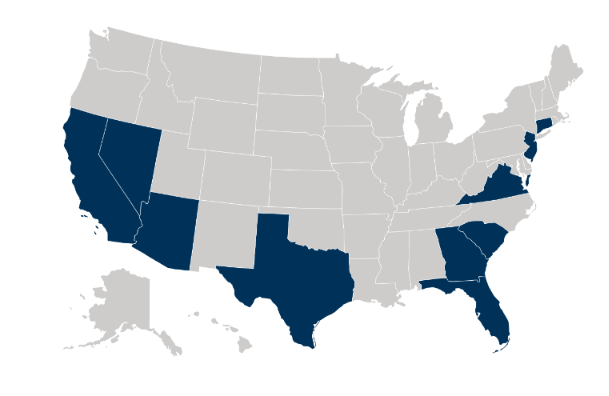

The program is currently only available in the following states:

- Arizona

- California

- Connecticut

- Florida

- Georgia

- New Jersey

- Nevada

- South Carolina

- Texas

Key Takeaways

Reverse Mortgage Loans: Key Takeaways

A reverse mortgage is a financial tool for homeowners 55 or 62 years of age or older (depending on the program) that utilizes the equity of their primary residence to gain access to a lump sum or pre-set monthly disbursements of cash and/or a line of credit without monthly loan repayment.

The most common reverse mortgage is the Home Equity Conversion Mortgage (HECM) which is backed by the Federal Housing Administration (FHA).

Some lenders will offer their own proprietary reverse mortgage including the Equity Avail reverse mortgage which is designed to help homeowners that don’t have quite enough equity to qualify for a standard reverse mortgage.

The Equity Avail reverse mortgage can drastically reduce the burden of a first mortgage for the first 10 years of the term and result in no mortgage monthly payment thereafter.